Financial Services

Schedule a Meeting With Sam Kirkendohl or Call 803-508-8701

Triple Crown Estate, Wealth & Insurance is here to help you manage your finances so you can pursue your ultimate goals.

Financial Planning

Our financial planning process is designed to be both comprehensive and straightforward, providing you with a clear path to achieving your financial aspirations. We understand that every individual has unique goals, which is why our approach focuses on crafting tailored financial strategies that are aligned with your specific needs. By partnering with us, you will take the crucial first step toward converting your financial dreams into achievable objectives, backed by our expertise and commitment to your success. Let us guide you on this journey, ensuring that your financial future is shaped precisely as you envision it.

Insurance Services

Many retirees incorrectly assume that their financial futures are secure, failing to recognize how significantly a market downturn can affect their income streams. Fortunately, there are effective insurance solutions available that extend beyond traditional asset protection; they can also serve as a safeguard for your financial future. We are dedicated to assisting individuals in fortifying their retirement savings through a diverse range of insurance products and strategic financial planning services. Our mission is to ensure that your nest egg remains protected, enabling you to enjoy a worry-free retirement. Let us help you prepare for the unexpected and secure your financial well-being for years to come.

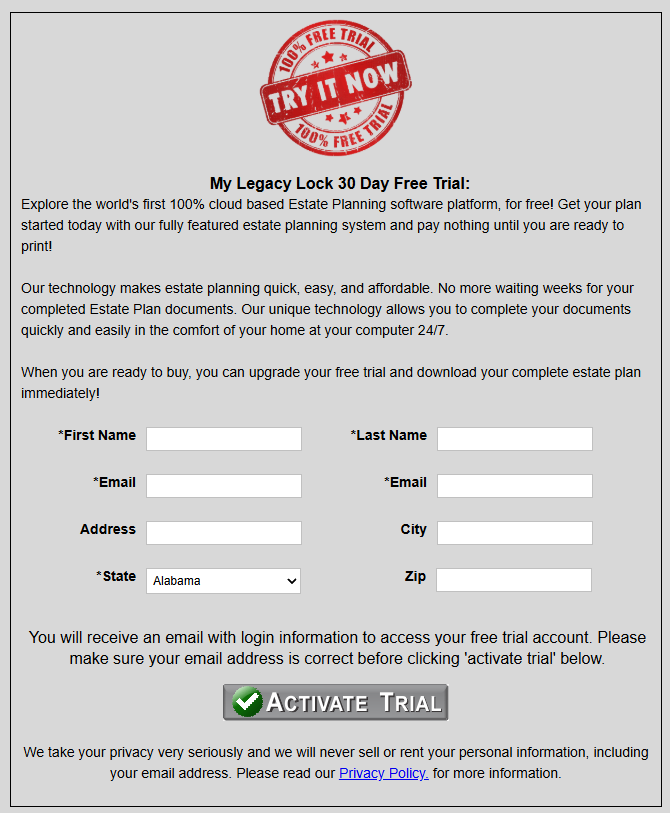

Estate Planning

Estate planning and legacy creation are pivotal considerations for retirees. The process of estate planning not only involves the distribution of assets but also ensures that your loved ones maintain harmony and communication after your passing. An unplanned estate can create friction and misunderstanding, even among the closest family members. Therefore, it is essential to incorporate a robust estate planning strategy into your comprehensive Retirement Plan. By doing so, you can provide clarity and peace of mind to your family, safeguarding relationships and ensuring that your wishes are honored. Take the necessary steps today to secure a positive legacy for those you cherish.

Medicare

What is Medicare and What Does it Cover?

Medicare is a vital federal health insurance program designed to provide coverage for individuals aged 65 and older, as well as for certain younger individuals who may qualify due to a disability or other exceptional circumstances. This program plays a crucial role in assisting millions of American seniors and disabled individuals by helping to alleviate some of their healthcare costs, ensuring access to essential medical services and preventive care. As a key component of the nation’s healthcare system, Medicare not only enhances the quality of life for its beneficiaries but also contributes to their overall well-being and financial security.

Retirement Planning

At Triple Crown Estate, Wealth & Insurance, we pride ourselves on building strong relationships with our clients by understanding their unique financial needs and aspirations. Our approach to retirement planning is comprehensive and personalized. We focus on addressing five critical questions to help guide our clients toward a secure and fulfilling retirement. By doing so, we ensure that every aspect of their financial future is thoughtfully considered, empowering them to make informed decisions with confidence. Whether it’s about income streams, investment strategies, tax implications, or legacy planning, our team is dedicated to providing professional guidance tailored to each individual’s circumstances.

Individual Planning

As you evaluate your financial health, it’s crucial to address several key areas to ensure you are on the right track for your future. First, consider whether you are maximizing the benefits of your 401(k), as this can significantly impact your retirement savings. Additionally, review your insurance policies to assess if you are adequately covered or potentially over-insured, which could be straining your budget unnecessarily. It’s also important to check if your current savings and retirement strategies align with your long-term financial goals. In the event of a market downturn, having a contingency plan can safeguard your investments and provide peace of mind.

A plan tailored to your objectives.:

Planning for retirement doesn’t have to be overwhelming; partnering with our seasoned team of advisors can streamline the process significantly. Together, we will develop a comprehensive financial strategy tailored to your unique goals, ensuring that you are well-prepared for the future. Our commitment to guiding you through each step of this journey will empower you to make informed decisions that align with your retirement vision. Let us help you turn your aspirations into a well-structured financial plan, providing you with peace of mind as you approach this important life stage.

Vision

Assessment

Strategy

Action

Ongoing Relationship

We offer services in these three areas:

GROW

Strategically leverage your hard-earned assets to effectively plan for retirement.

HOW?

Annuities

Asset Protection

Charitable Giving

College Funding

Deferred Income Annuity

Estate Planning

Fixed Indexed Annuities

Guaranteed Income

Immediate Annuity

PRESERVE

Safeguard the resources essential for achieving your envisioned retirement lifestyle.

HOW?

Income Planning

Investment Planning

IRA & 401(K) Assets and Planning

IRA, 401(K) and 403(B) Rollovers

IRA Legacy Planning

Legacy Planning

Lifetime Income Planning

Probate

Retirement Income Planning

GIVE

Support the individuals and initiatives that hold the most significance to you.

HOW?

Retirement Income Strategies

Safe Money Options

Social Security

Tax Advisory

Tax-Efficient Strategies

Tax Planning

Wealth Management

Wealth Planning

Wills, Trusts, Estates

Regular Review

Your life will change, and we understand that your plan must evolve alongside it. During our regular plan reviews, we meticulously assess your progress, make necessary adjustments based on new insights, and ensure all information remains current and relevant. Our dedicated support team is always available to provide timely answers to your questions, ensuring you are never left in the dark. Regular plan reviews are an integral part of our commitment to doing things the right way and empowering you to achieve your goals. Let’s work together to keep your plan aligned with your life’s journey.